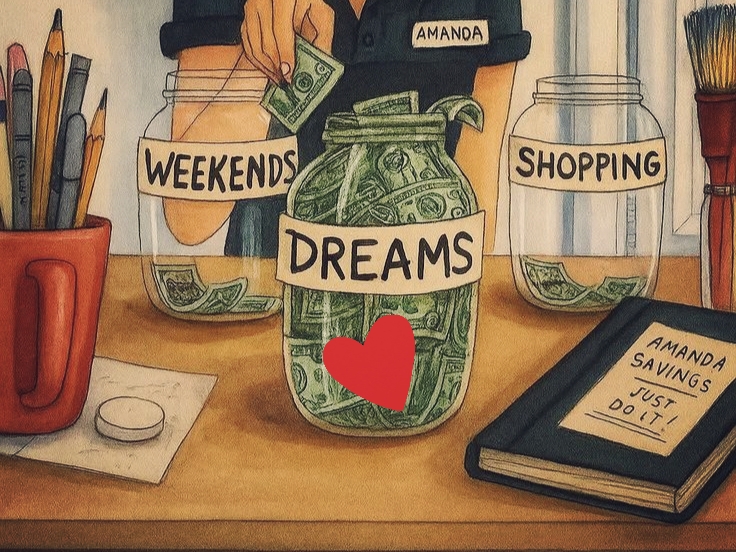

Youth today face a financial jungle—skyrocketing rents, tempting TikTok hauls, and FOMO-driven spends. But saving money for beginners doesn’t require a finance degree or millionaire parents. This ultimate listicle arms you with 50+ actionable hacks, broken into categories, to stack cash fast. Start small, stay consistent, and watch your bank account grow while your friends chase trends.

Whether you’re a college student juggling gig apps or a young professional eyeing that superbike, these tips fit your vibe. Dive in, apply one today, and level up your money game.

Table of Contents

Why Saving Money for Beginners Matters for Youth Like You

Saving money for beginners unlocks freedom. Stats show 78% of Gen Z live paycheck-to-paycheck (Bankrate’s 2025 Financial Literacy Survey), but early savers retire millionaires. Compound interest turns $100/month at 20 into $500k by 60. Youth have time on your side—act now.

This guide skips fluff. Grab a notebook, track progress, and transform “broke” into “boss.”

1. Mindset Shifts: 10 Game-Changing Attitudes for Saving Money for Beginners

Kick off with psychology. Saving money for beginners starts in your head—rewire for wins.

- Embrace the “Future You” Vision: Picture 30-year-old you debt-free on a Bali trip. Apps like FutureMe visualize this. Commit daily—savings grow 20% faster with goals (Harvard Business Review study).

- Ditch “I Deserve It” Traps: Social media pushes instant gratification. Pause 48 hours before buys over $50. Youth impulse-spend 30% less this way (NerdWallet data).

- Track Your “Money Temperature”: Rate spends on a 1-10 joy scale. Cut low-scorers. Tools like Mint gamify this for beginners.

- Adopt “Pay Yourself First”: Auto-transfer 10% of income to savings on payday. Beginners build $1k emergency funds in 10 months.

- Celebrate Micro-Wins: Hit $100 saved? Treat to coffee (under $5). Dopamine fuels habits—key for youth ADHD brains.

- Reframe “Saving” as “Winning”: You’re not deprived; you’re leveling up. Share progress on Instagram Stories for accountability.

- Ignore Peer Pressure: Friends splurge? Curate your feed with #FrugalYouth. Surroundings shape 40% of habits (APA research).

- Set “No-Spend Challenges”: One weekend/month, zero non-essentials. Beginners save $200/month average.

- Visualize Debt as a Monster: Name it (e.g., “Credit Card Goblin”). Slay it monthly—motivation soars.

- Audit Your Beliefs: Journal “Money is hard” myths. Replace with “Saving money for beginners is simple fun.”

- The Hidden Cost of Negative SelfTalk: 25 Shocking Ways It Sabotages Your Youth

These shifts alone boost savings by 25% in 90 days. Ready for tactics?

2. Budgeting Basics: 12 Foolproof Ways to Control Cash Flow

Budgets aren’t chains—they’re superpowers. Saving money for beginners thrives on simple systems.

- Use the 50/30/20 Rule: 50% needs (rent/food), 30% wants (eats out), 20% savings. Tweak for youth: 60/20/20 if entry-level pay.

- App-Powered Tracking: PocketGuard or YNAB auto-categorizes. Beginners spot $150/month leaks like unused subs.

- Zero-Based Budgeting: Assign every rupee a job. End month at zero—overflow to savings.

- Weekly Cash Envelopes: Digital via apps like Goodbudget. Youth love tactile control—cuts dining out 40%.

- Income Buckets: Split pay into “Essentials,” “Fun,” “Future.” Auto-allocate for effortless saving.

- Bill Calendar Hack: Pay bills Day 1. Protects savings from “forgotten” fees.

- Expense Forecasting: Predict next month’s spends using last month’s data. Adjust pre-emptively.

- Shared Google Sheets: Couples/roommates? Collaborative budgeting builds team savings.

- “Sinking Funds” for Goals: Pre-save for trips/gadgets. $20/week = $1k/year guilt-free.

- Quarterly Reviews: Analyze trends. Beginners pivot fast—e.g., drop gym if home workouts suffice.

- Emoji Budgets: Fun for youth—🍕 for food, 💸 for savings. Visuals stick.

- Reverse Budgeting: Start with savings goal ($200), subtract from income. Forces cuts.

Link up: Master spreadsheets with Google Sheets Budget Templates.

3. Cutting Expenses: 15 Sneaky Hacks to Slash Costs Without Sacrifice

Youth spends kill savings. Hunt leaks smartly—saving money for beginners means living large on less.

- Meal Prep Like a Pro: Batch-cook Sundays. Saves $300/month vs. Swiggy/Zomato.

- Cancel Phantom Subs: Audit Netflix, Spotify duplicates. Beginners reclaim $50-100/month (Forbes report).

- Shop Second-Hand: Depop/OLX for clothes/tech. Youth score 70% discounts.

- Public Transport Wins: Apps like Cityflo for passes. Ditch Uber—save ₹5k/month in metros.

- Energy Audits: LED bulbs, unplug chargers. Bills drop 15% (EIA.gov).

- Library Over Streaming: Free books/movies. Builds habits minus cost.

- DIY Coffee/Drinks: Home brews cost ₹10 vs. ₹150 café. Weekly $50 saved.

- Bulk Buying Smart: Costco/Reliance Smart for non-perishables. Per-unit savings 25%.

- Negotiate Bills: Call providers—youth get 10-20% discounts citing competitors.

- Free Events Hack: Meetup/Eventbrite for hangs. Zero entertainment cost.

- Clothing Capsule: 30 pieces max. Rotate—laundry/cost down 50%.

- Phone Plan Swap: Jio/Airtel budget plans. Save ₹500/month.

- Gift Experiences: Homemade over bought. Holidays cheaper, meaningful.

- Car-Free Weeks: Cycle/walk. Fuel + maintenance slashed.

- Price Tracking Apps: Keepa/Honey alerts deals. Beginners snag 30% off Amazon.

4. Boosting Income: 10 Side Hustles Perfect for Young Beginners

Saving money for beginners accelerates with extra cash. Youth energy = hustle gold.

- Freelance Gigs: Upwork for writing/design. Beginners earn ₹10k/month part-time.

- Content Creation: TikTok/YouTube shorts on saving tips. Monetize views—youth niche king.

- Gig Apps: Swiggy/UrbanClap deliveries. Flexible $200/week.

- Tutoring Online: Teach peers via Zoom. ₹500/hour easy.

- Resell Sneakers: StockX flips. Low entry, high margins.

- Pet Sitting: Rover app. Fun, ₹1k/day.

- Surveys/Microtasks: Swagbucks/Google Opinion. Pocket money while scrolling.

- Print-on-Demand: Teespring custom merch. Passive after setup.

- Campus Jobs: Barista/tutor. Builds resume + cash.

- Rent Gear: Camera/bike on Fat Llama. Unused assets = income.

External boost: Explore Upwork’s Beginner Guide.

5. Smart Saving Tools: 8 Apps and Accounts for Effortless Growth

Tech makes saving money for beginners automatic.

- High-Yield Savings: Groww/Smallcase at 7%+ interest. Beats bank 4%.

- Round-Up Apps: FamPay rounds purchases, saves change.

- ACATs/RDs: Auto-debit fixed sums. Discipline baked in.

- Goal Trackers: Goalsetter for youth—fun, visual progress.

- Crypto Staking (Low-Risk): Binance Earn for beginners. 5-10% APY.

- Index Funds: Zerodha for SIPs. Start ₹500/month.

- Cashback Wallets: Paytm/PhonePe. Everyday spends fund savings.

- Envelope Apps: Goodbudget digitalizes cash method.

6. Avoiding Pitfalls: 10 Red Flags and How to Dodge Them

Saving money for beginners fails on traps. Steer clear.

- Lifestyle Inflation: Raise? Save 50% first.

- Emotional Spending: Journal before buys.

- Scam Alerts: Verify apps/sites—use RBI Fraud Checker.

- Credit Card Debt: Pay full monthly.

- FOMO Investments: Stick to index funds.

- No Emergency Fund: Build 3 months’ expenses first.

- Ignoring Inflation: Save ahead—prices up 6%/year.

- All Eggs in One Basket: Diversify.

- Procrastination: Start today—compound magic.

- Bad Advice: Vet influencers; use NerdWallet/Investopedia.

7. Advanced Beginner Strategies: 8 Long-Term Plays for Youth Wealth

Level up saving money for beginners.

- Roth IRA Equivalent: PPF/EPF for tax-free growth.

- House Hacking: Rent roommate spot.

- Skill Investments: Free Coursera courses boost income 20%.

- Minimalism Challenge: 30-day purge—sell extras.

- Travel Hacking: Points from spends fund trips.

- Peer Lending: LenDenClub low-risk 10% returns.

- Automate Everything: Zapier links apps.

- Annual Audits: Reset goals yearly.

Real Youth Stories: Proof Saving Money for Beginners Works

- Aisha, 22, Bangalore: Meal preps + freelancing = ₹2L saved in a year. Bought iPhone cash.

- Raj, 19, Student: No-spend + apps = ₹50k fund. Funded internship abroad.

- Priya, 25, Mumbai: 50/30/20 + hustles = dream superbike deposit.

Quick-Start 7-Day Challenge for Saving Money for Beginners

- Day 1: Track all spends.

- Day 2: Cancel 1 sub.

- Day 3: Meal plan.

- Day 4: Side hustle listing.

- Day 5: Budget setup.

- Day 6: Auto-save 10%.

- Day 7: Review + celebrate.

Tools and Resources Roundup

| Category | Top Pick | Why for Beginners |

|---|---|---|

| Budgeting | YNAB | Teaches zero-based magic |

| Tracking | Mint | Free, auto-cats |

| Savings | Groww | High interest, easy |

| Hustles | Upwork | Youth-friendly gigs |

| Learning | Khan Academy Finance | Free courses |

Final Push: Your Saving Money for Beginners Action Plan

Pick 5 tips today. Track weekly. In 6 months, you’re transformed. Youth like you build empires starting now.

Questions? Drop specifics on your situation—like city spends or goals—and I’ll customize further.