Personal Finance for Gen Z: Gen Z crushes trends, memes, and viral challenges—now it’s time to crush personal finance for Gen Z. You’re digital natives facing inflation, student loans, and gig economy chaos, but with the right playbook, you build wealth faster than your parents’ 401(k). This mega listicle packs 50+ tips into bite-sized, youth-approved strategies. Skip the boring lectures; grab apps, side hustles, and mindset hacks that fit your vibe.

We break it down into 10 categories: budgeting, debt, earning, saving, investing, taxes, credit, insurance, mindset, and future-proofing. Each tip includes why it works for Gen Z, step-by-step action, and real-world examples. Ready to level up your money game? Let’s dive in.

Table of Contents

1. Personal Finance for Gen Z: Budgeting Basics: Track Every Penny Like a TikTok Algorithm

Personal Finance for Gen Z: Budgeting isn’t lame—it’s your financial superpower. Gen Z spends 27% more on experiences than millennials did at your age (per McKinsey). Master it to fund those trips without regret.

- Adopt the 50/30/20 Rule, Gen Z Style. Allocate 50% to needs (rent, food), 30% to wants (coffee runs, concerts), 20% to savings/debt. Use apps like YNAB (You Need A Budget) to automate. Example: Earning $3k/month? Stash $600 automatically.

- Zero-Based Budgeting for Impulse Buyers. Assign every dollar a job before the month starts. Apps like PocketGuard flag overspending. Track FOMO buys—saved one Gen Zer $200/month on Uber Eats.

- Weekly Micro-Budgets. Break monthly plans into $50 weekly pots. Apps notify overspends instantly. Pro tip: Gamify with streaks on Goodbudget.

- Subscription Audits Quarterly. Gen Z averages 10+ subs ($200/year waste, per C+R Research). Cancel unused ones via Rocket Money.

- Envelope System Goes Digital. Load virtual envelopes in Goodbudget for categories like “fun money.” Forces cash-like discipline.

- 75 Practical Ways Youth Can Thrive in a Minimalist Money Lifestyle

2. Personal Finance for Gen Z: Slaying Debt: Escape the Student Loan Trap

Personal Finance for Gen Z: U.S. Gen Z owes $1.6 trillion in student debt alone (Federal Reserve). Attack it aggressively without sacrificing life.

- Debt Snowball for Quick Wins. List debts smallest to largest; pay minimums on all, extra on tiniest. Psychology boost keeps momentum (Dave Ramsey method).

- Avalanche Method for Math Whizzes. Target highest interest first. Save thousands: 6% credit card vs. 4% loan? Crush the 6% (Bankrate calculator).

- Refinance Student Loans Now. Rates dropped—Gen Z saves 1-2% via Credible. Check eligibility; one user dropped payments $150/month.

- Side Hustle Debt Blitz. Dedicate 100% of gig earnings to debt. DoorDash + loans = freedom in 18 months.

- Negotiate Medical Bills. 60% success rate for Gen Z (KFF). Call providers; cite hardship.

3. Personal Finance for Gen Z: Earning Extra: Side Hustles That Fit Your Schedule

Personal Finance for Gen Z: Gen Z wants flexibility—70% have side gigs (Handshake). Stack skills for $1k+/month.

- Freelance on Upwork/Fiverr. Offer Gen Z gold: TikTok editing, Canva graphics. Top earners hit $5k/month.

- Content Creation Cash. Monetize Instagram Reels or YouTube Shorts on personal finance for Gen Z. Affiliate links via Amazon Associates.

- Gig Apps Mastery. Uber, TaskRabbit, Rover—optimize for peak hours. One Gen Zer nets $800/month dog-walking.

- Sell Digital Products. Etsy printables or Gumroad courses on budgeting. Passive income scales.

- Tutor Online. Platforms like Preply pay $20/hour for subjects you ace.

| Side Hustle | Startup Cost | Hourly Potential | Gen Z Fit |

|---|---|---|---|

| DoorDash | $0 | $15-25 | Flexible shifts |

| Fiverr | $0 | $20-100 | Creative skills |

| Tutoring | Laptop | $20-50 | School smarts |

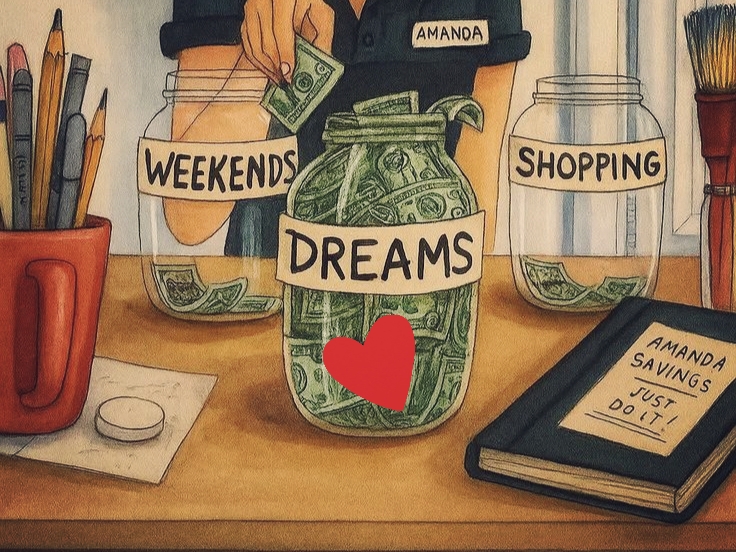

4. Saving Hacks: Automate Wealth Like a Boss

Saving feels impossible with avocado toast memes, but automation changes everything. Aim for 3-6 months’ expenses.

- High-Yield Savings Accounts. Ditch 0.01% bank rates for 5% APY at Ally or SoFi. $5k grows $250/year.

- Round-Up Apps. Acorns invests spare change. Gen Z fave: $10k invested from coffee rounds.

- Employer 401(k) Match. Free money—contribute 5% if matched (Vanguard).

- Cash Envelope Challenges. No-spend weeks via apps; build emergency fund fast.

- Travel Rewards Hacking. Cards like Chase Sapphire Preferred fund trips free.

5. Investing 101: Grow Money While You Scroll

Personal finance for Gen Z means investing early—compound interest is your superpower. Start with $100.

- Index Funds for Set-It-and-Forget. Vanguard S&P 500 (VFIAX)—beats 90% of pros long-term.

- Robo-Advisors Like Wealthfront. Auto-portfolios from $500; 0.25% fees. Gen Z-friendly.

- Roth IRA Magic. Contribute post-tax; withdraw tax-free at 60. Max $7k/year 2026 (IRS).

- Crypto Caution Play. Allocate 5%; use Coinbase for Bitcoin/ETH. DCA (dollar-cost average) monthly.

- ESG Funds for Values. Invest in green tech via Betterment.

Investment Starter Portfolio for Gen Z

- 60% Index Funds

- 20% Bonds/Stablecoins

- 10% Crypto

- 10% Individual Stocks (e.g., Tesla)

6. Taxes Demystified: Keep More of Your Hustle Money

Gen Z files 1099s from gigs—don’t overpay. Save 20% automatically.

- Freelancer Tax Apps. QuickBooks Self-Employed tracks mileage/deductions.

- Max Deductions. Home office, internet, phone—claim on TurboTax.

- Quarterly Estimated Payments. Avoid penalties; IRS calculator here.

- Education Credits. Lifetime Learning Credit up to $2k (IRS).

- State Tax Hacks. Research moves to no-income-tax states like Texas.

7. Credit Scores: Unlock Loans and Apartments

Bad credit blocks rentals—Gen Z average score 688 (Experian). Fix it now.

- Secured Cards First. Discover it Secured builds history.

- Pay Bills on Time (Duh, But Automate). 35% of score; use Mint.

- Authorized User Trick. Join parent’s good-standing card.

- Credit Builder Loans. Self reports payments positively.

- Dispute Errors Free. AnnualCreditReport.com weekly checks.

8. Insurance Essentials: Protect Your Grind

Skip it, regret it. Gen Z needs affordable coverage.

- Renters Insurance. $15/month via Lemonade covers theft.

- Health Sharing Plans. Cheaper than ACA for healthy hustlers (Zion Health).

- Term Life Early. $20/month for $500k coverage (Policygenius).

- Gig Worker Coverage. Uber provides some; supplement with Lemonade.

- Phone/Laptop Insurance. Via carriers—protect tools.

9. Money Mindset: Rewire for Wealth

Personal finance for Gen Z starts in your head. Ditch scarcity vibes.

- Abundance Affirmations Daily. “Money flows to me easily.” Apps like ThinkUp.

- Financial Therapy Apps. Money Mindful tackles shame.

- Track Net Worth Monthly. Free template here.

- No-Shame Splurges. Budget 5% for guilt-free fun.

- Community Accountability. Join Reddit’s r/personalfinance or Gen Z Discord groups.

10. Future-Proofing: Retire Rich, Retire Early (FIRE for Gen Z)

Plan for AI jobs, recessions, and longevity.

- Backdoor Roth if High Earner. Convert traditional IRA (Investopedia guide).

- Real Estate via REITs. Fundrise from $10.

- Skill Stacking. Learn AI + finance for $200k jobs (Coursera).

- Estate Planning Basics. Free will via FreeWill.

- Annual Reviews. Reassess goals; adjust for life changes.

- Bonus: Emergency Roth Ladder. Penalty-free access to contributions.

- Crypto IRAs. Tax-advantaged via iTrustCapital.

- Gig Economy Pensions. Platforms like Uber test 401(k)s—opt in.

Why Gen Z Wins at Personal Finance

You grew up with apps, memes, and recessions—adaptability is your edge. Implement 10 tips today; track progress in 90 days. Personal finance for Gen Z isn’t about sacrifice; it’s amplification. Compound your hustle, and by 30, you’re the rich friend.

Sources & Further Reading: All data cited; explore NerdWallet Gen Z Guide or Investopedia Basics.